6 Borrowing from the bank Strengthening Programs to simply help Improve your Credit history

For many, a credit history are a prized achievement, with studies stretching on 700 or 800 well worth range. For many individuals regardless if, a credit rating are a variety that could be improved.

Many Americans has a credit score less than 700, obtaining increased get can help you secure most readily useful terminology on money, along with down rates of interest. Exactly what if you would like help with your credit rating? As the saying goes, is there a software for the?

Luckily for us, there are in fact certain software to replace your borrowing from the bank rating. Using an app may take for you personally to improve your credit history, but a software can help you that have getting ready for a far more powerful monetary future.

Since the costs are created, Notice reports your own to the-date money toward three no. 1 credit reporting agencies (Experian, TransUnion and you can Equifax), helping improve your credit history

- Experian

- Borrowing from the bank Karma

- Self

- Kikoff

- MoneyLion

- Develop Borrowing from the bank

Because the repayments are produced, Thinking accounts your own for the-date payments on three number one credit bureaus (Experian, TransUnion and Equifax), helping to boost your credit history

- No-costs up-to-date check your Experian get

- Subscription for real-date credit overseeing

- 100 % free Experian Improve to increase credit score

Experian is just one of the around three big credit bureaus you to definitely accumulates and you will account debt advice because the a good three-thumb amount – aka your credit rating .

A credit history helps other companies determine how high-risk it is to loan you currency considering your own borrowing from the bank and you may percentage background.

Insights what your location is is best treatment for begin to build your credit rating

Regarding totally free Experian software, you can examine their most recent Experian credit score and you may scores off Equifax and you will TransUnion, which happen to be current yearly.

If you decide to buy this new Experian app, you can obtain their latest credit history about almost every other one or two bureaus. The latest registration is expensive but also provides a complete image of their most recent credit disease.

One free feature we like try Experian Raise, hence adds recurring expenses into credit file to aid improve your credit rating. You need at the very least about three repeating money, such as for example power bills otherwise constant memberships in order to HBO Maximum or Netflix.

If you’ve ever wrestled along with your credit rating, you have most likely made use of or perhaps heard of Borrowing Karma . Which personal monetary institution assists Us americans pick their fico scores on free of charge.

Regardless of if Credit Karma’s credit history reporting is exorbitant on account of utilising the Vantage scoring system, instead of the more common FICO credit score. Still, the Vantage credit score shall be sufficient to make you an effective harsh notion of where you’re.

Several other notable quirk: Borrowing from the bank Karma only accounts TransUnion and Equifax scores. You will need to alone check your Experian credit history, often on the internet or even in this new Experian software.

The true reasoning we love Borrowing from the bank Karma is that the software demonstrates to you the fresh new negative and positive products inside your scores, enabling you to pick items in order to right them and you will change your credit score.

The service also offers created-in the gadgets to possess training credit cards and you will finance you to top matches your existing financial predicament and you can credit score.

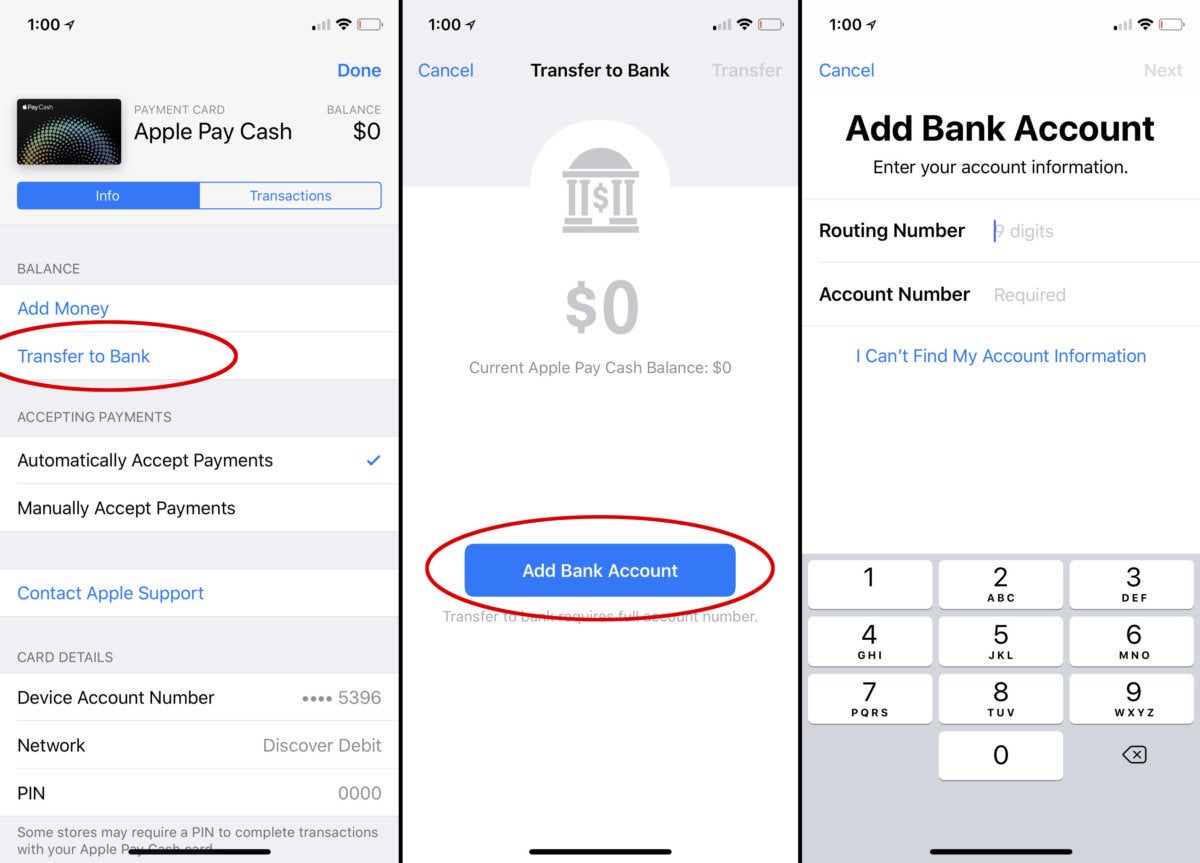

This registration-established application allows you to sign up for a tiny financing and you will pay it off so you can make borrowing from the bank. (Your actually rating every cash back in the end.)

To start, get a card Creator account with Mind and obtain good credit builder mortgage. Don’t be concerned. There won’t be any hard brings on your own credit history. Once approved, you could potentially look for a payment number and you can financing overall to start making costs.