To possess financing numbers greater than $3MM (otherwise $2MM for financial support properties), people must see article-closing house conditions so you can be considered

Whenever debating between leasing vs. to acquire, you need to think about your lifetime and you can profit. While renting also have a lot more liberty, home ownership makes you make equity on the possessions and may even offer taxation masters.

The fresh apr (APR) ‘s the cost of credit along side label of the financing expressed due to the fact a yearly rate. Brand new Apr shown let me reveal in line with the interest rate, any write off factors, and you can mortgage insurance policies to own FHA money. It does not consider the processing payment or one other loan-particular financing fees you happen to be needed to pay. Cost try projected by the condition and real prices may vary.

Purchase: Prices displayed throughout the table are whenever step one point as they are according to the after the assumptions: compliant 31-12 months repaired, 15-12 months fixed, 7/six Sleeve and 5/six Sleeve predicated on a loan amount from $350,000 having a down-payment out of 20%. 30-year fixed FHA according to an amount borrowed from $250,000 that have a downpayment of five%. 30-year fixed jumbo and you can ten/6 Focus Merely Arm jumbo items are according to that loan quantity of $step one,3 hundred,000 which have an advance payment out of 30%. The finance imagine just one-nearest and dearest house; get financing; home loan rates secure period of 30 https://paydayloanalabama.com/bay-minette/ days and you may customer reputation which have higher level borrowing from the bank. Select projected monthly payments. Pick estimated monthly premiums.

A beneficial preapproval is based on a look at earnings and you will resource pointers your give, your credit report and an automated underwriting system review

Refinance: Prices demonstrated on table are just as much as step 1 dismiss section and you will depend on another assumptions: conforming 30-seasons repaired, 15-12 months repaired, 7/6 Case and 5/six Arm based on a loan amount out of $350,000 with a loan so you can property value 55%. 30-season repaired Jumbo and you will 10/6 Appeal Just Arm jumbo items are according to that loan amount of $step one,3 hundred,000 having a loan so you can worth of 55%. Discover projected monthly obligations. Find projected monthly installments.

All the finance guess just one family relations residence, refinance mortgage, mortgage speed secure ages of forty-five weeks in all claims except New york which includes a rate secure age of two months and customers character that have higher level borrowing

Depending on their credit character and loan amount, interest-merely financing arrive and offer with the fee interesting simply for a flat time frame, and payments out-of principal and notice thereafter throughout the mortgage label. And come up with desire-just costs, prominent is not quicker. After this period, your monthly payment will increase.

Funds to 85% regarding an excellent residence’s worthy of arrive on a purchase otherwise re-finance without cash return, subject to assets kind of, an essential lowest credit rating and at least level of month-to-month reserves (i. Tool constraints implement. Jumbo loans offered as much as $9. Extra constraints could possibly get use. Delight contact a good Chase Family Credit Mentor for facts. The newest DreaMaker mortgage is available no-cash-aside refinance of an initial residence step one-cuatro unit assets to possess 29-season repaired-rates words. Earnings restrictions and homebuyer degree course will become necessary when every mortgage people was first-time homebuyers. FHA financing wanted an up-front financial insurance premium (UFMIP), which might be funded, or repaid in the closure, and you can an enthusiastic FHA annual home loan cost (MIP) paid month-to-month will also apply.

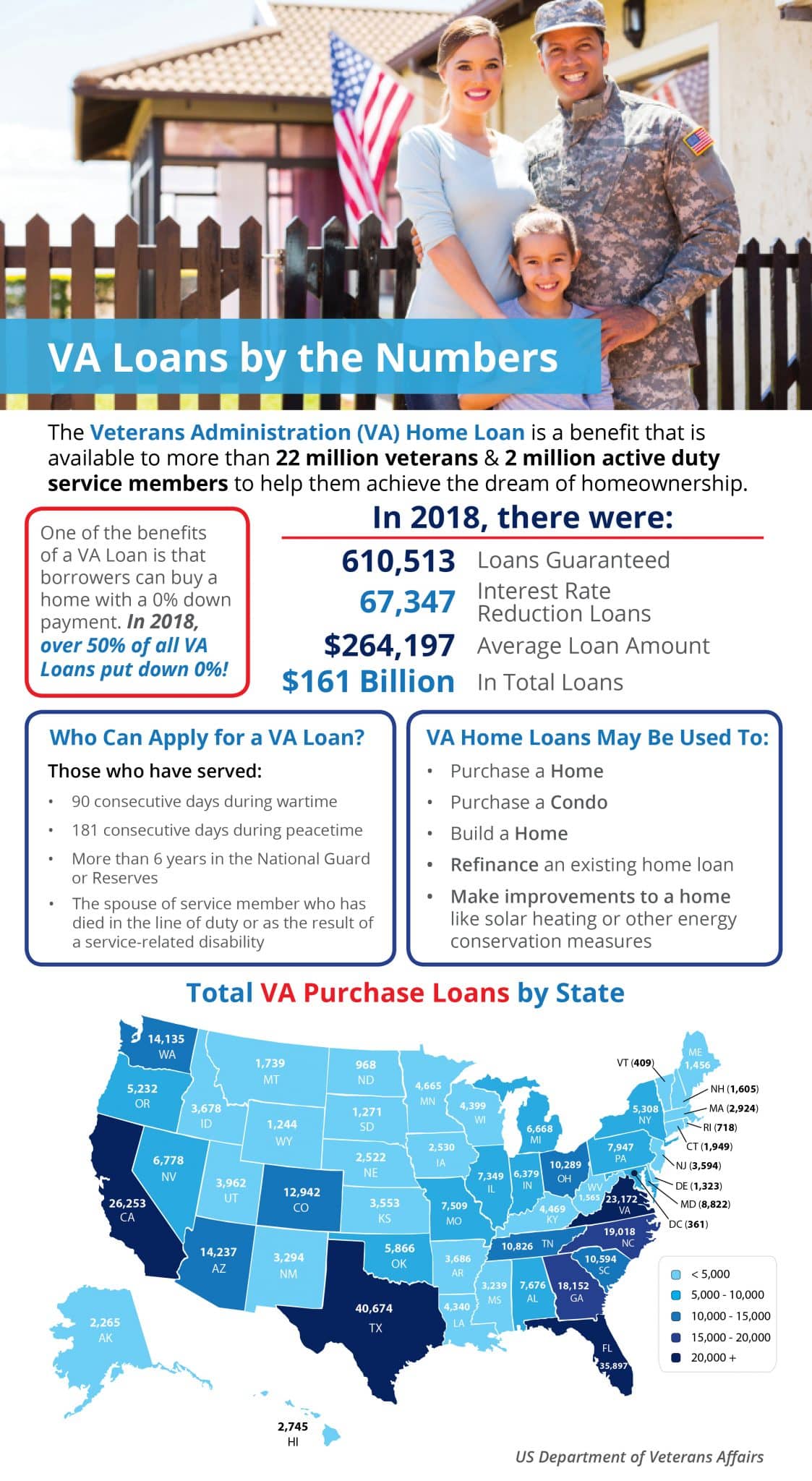

Veterans, Servicemembers, and you can members of the Federal Guard otherwise Reserve could be qualified for a financial loan guaranteed of the U. S. Agency out of Veteran Circumstances (VA). A certification out-of Qualification (COE) on the Va must document qualification. Limitations and restrictions pertain. The brand new issuance out of an effective preapproval letter isnt that loan commitment or a vow to own mortgage acceptance. We might provide financing partnership when you submit an application and we manage a final underwriting review, as well as verification of any advice given, possessions valuation and you will, if applicable, investor approval, that may bring about a switch to new regards to their preapproval.