How In the near future Is it possible you Make use of Home Equity?

Thinking if or not you could potentially otherwise is borrow secured on your house? These represent the top situations you will want to envision while choosing to make use of your residence guarantee.

If you have has just purchased your property, you now have a different sort of financial advantage that one can faucet to own money: your home security.

Your residence guarantee is the difference between their residence’s you could check here market price and the loan harmony you still are obligated to pay up against it. So basically your own residence’s worthy of (without your own mortgage harmony.)

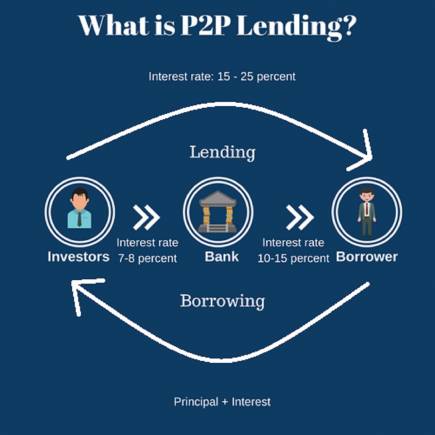

But not, your home collateral is not instance a checking account, where you could mark money when. You can find some other financial products you can use to help you availability your property equity, eg house collateral fund, HELOCs, or an earnings-away re-finance.

Thus whether you are trying upgrade your house otherwise pay for another essential debts, there are tips that will dictate when you can be tap into your home equity, how much you can easily obtain, whenever you probably should tap into your house security.

Just how Following To invest in property Do you Receive property Security Loan?

Technically you could take-out property security financing, HELOC, or cash-out refinance once you purchase a home.

But not, you don’t pick lots of anyone performing this because you would not provides much collateral to attract regarding one to in the beginning.

Consider this: you’ve repaid your own down payment, for from around 5-20% of your total purchase price, following maybe you have made a few mortgage payments.

If the domestic is $five hundred,000 while place 20% off, you might be you start with $100,000 in home collateral. One feels like a lot!

But lender regulations turn one to lot into the a small. According to really finance companies or borrowing unions, the sum of the the financial balance and your wished household security loan amount can’t be a lot more than 85% of your own home’s well worth.

You might merely borrow $twenty five,000, and many loan providers limit borrowing within 80% of your residence’s well worth, thus therefore, you would not obtain anything.

And so the matter most actually how soon ought i borrow on my personal family guarantee, its when am i going to have enough family guarantee to help you borrow on.

How long Before a house Enjoys Collateral in order to Utilize?

On average, your house commonly take pleasure in cuatro% yearly. Therefore without purchasing anything more, your residence will obtain well worth, which goes in your home collateral. Very! Your property could actually acquire more worthiness than simply that, otherwise reduced, for the a given 12 months – depending on the housing marketplace.

For example, during the 2021, home increased their worth by the 14% an average of because the real estate , home values stopped by nine.5%.

Although not, in addition still need to make your monthly mortgage repayments, and this will feel the most lead affect your home guarantee.

Really mortgages has actually 10, fifteen, 20, otherwise 30-season payment words. New stretched the new commission label, the much slower your own equity is about to make.

Specific residents find yourself and make big repayments or paying off their mortgages very early to improve guarantee faster, but some mortgage loans provides prepayment penalties, meaning that added fees if you try to invest over your own monthly bill.

If you would like know when you should have a quantity out-of domestic security as you are able to tap into, here are a few property security calculator on line along these lines one to mess around towards the number.

Can you Rating a loan Instead Collateral?

RenoFi Money (and HELOCs, fixed-speed domestic security fund, and you may RenoFi Refis) enables you to utilize your home’s upcoming equity today to help you funds home home improvements.

RenoFi Finance are formulated for new home owners without much collateral that trying to remodel and don’t have a good financing substitute for play with.