Remember that these types of fund may have high interest levels and you may charges

If that’s your position, you’ll need to consider strategically. It is possible to end up getting a few mortgage loans (if any mortgage loans anyway) for a time. You’ll also need certainly to look at the needs and you will wishes of most other people and suppliers on it.

It will be daunting, you could make this situation meet your needs. First off, take a breath. Today, listed here are your options for buying property when you find yourself promoting your own current that.

It will is reasonable to sell your house before you buy the next domestic. Most residents require collateral from their latest the home of make a deposit on the second home. You may do not want buying one or two mortgages within once.

However, that one gift ideas some challenges. For folks who sell your residence one which just romantic on the next domestic, you’ll want to pick somewhere to reside in anywhere between. Below are a few a means to deal with selling before buying.

Discuss the closing go out.

Your discovered a purchaser for the latest household-whew! Exactly what if for example the consumer requests a closing time that does not get off time to move into your home? Make an effort to discuss to own another day. You can also have the ability to negotiate both closings on your current family plus 2nd household that occurs on a single go out for a seamless change.

Arranged a rent-back contract.

Having a lease-right back agreement, you discuss in which to stay your residence getting a selected number of your energy (constantly no more than 2 to 3 days). Inturn, you either pay-rent to the people otherwise acknowledge an effective how much would a $500 payday loan cost all the way down cost. This will help to you prevent an extra disperse before you could settle with the your next home.

Stick to relatives otherwise nearest and dearest.

In case your consumer needs to move around in quickly or isn’t really receptive so you can a rental-right back contract, you might stick to loved ones or relatives. This option could help prevent an inconvenience and you will spend less from inside the a trending housing market that have limited collection.

Buy short-term homes.

A primary-name local rental is another choice to link the new pit ranging from residential property. Residing in a condo, condo, extended-sit resorts, or travel local rental will be costly. Although expense may be worth new reassurance from attempting to sell your existing family before you buy the following one to.

Fool around with portable stores bins.

If you are not swinging directly into your future house, consider using cellphone storage pots while you’re during the limbo. Such rentable pots was brought to both you and are going to be held offsite to possess however a lot of time need; upcoming, they have been relocated to the new household as you prepare in order to unpack.

Promoting your current household ahead of closing on your second that is not usually possible. Perchance you need to move in having an alternate business, or you should work quick on your dream domestic before it becomes away. During the an aggressive sector, often you should move quickly simply to come-out to come of almost every other even offers.

This might need spending a few mortgage loans, but that is not at all times the scenario. Here are some ways to believe once you pick first, following sell.

Discuss bargain contingency.

Once you setup a deal for the a special home, you could potentially demand a deal which is contingent into income from your existing home. Inside a competitive markets with many passionate people, of several sellers may not undertake it backup. In case a seller does not have any many curious buyers, they’re alot more available to it.

A beneficial contingent offer generally speaking boasts an important caveat: When the a separate consumer renders an offer towards the family, you get best away from first refusal. This provides your a day to eliminate the newest backup and you will disperse submit to your family buy otherwise leave in the selling completely. For folks who allow the home wade, you happen to be able to retain their serious currency.

Remove one minute mortgage.

If you possess the means, you could potentially only spend two mortgages simultaneously. However, even although you makes so it work in your finances, you still need so that you can be eligible for two mortgage loans.

Loan providers look at the loans-to-earnings proportion whenever choosing if you qualify for an additional home loan. Whether your the latest mortgage resources the debt-to-earnings ratio too high, you may not be eligible for your future financial until you promote the first home. Paying several mortgages may also be more costly because interest rates features spiked as a result to help you rising cost of living.

Book your current house.

If you’re not in a position to offer the dated domestic easily, you could book it out to aid security the costs. Do not forget to cause of the other really works inside it if you wade that it route-try to find tenants and you may serve as a property owner. This 1 including would not let you tap into your residence’s collateral.

Take out a link mortgage.

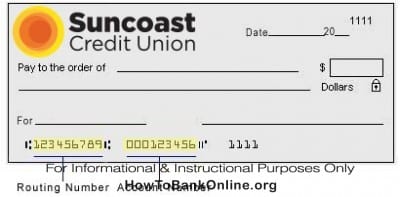

For folks who rely on the brand new collateral from your own home to fund the brand new deposit in your new home, a link financing might help. Of a lot creditors provide these types of loan, and therefore enables you to borrow money to possess a down payment when you wait with the business of your home. you will should keep make payment on financial on the current family up to they deal.

Tap into discounts.

In the a competitive industry, you might be capable justify tapping an urgent situation financing otherwise other coupons as you waiting to offer your home. Consult a monetary elite group before withdrawing out of retirement or other money accounts; you are able to deal with penalties to possess very early withdrawals. Make sure to exchange financing you withdraw whenever you offer your house.

Buying and selling at the same time would be difficult, however you have numerous choices to find the correct strategy for you. Slim towards the solutions of one’s mortgage lender and a residential property representative to discover the best solution to you personally and your loved ones.