School funding, Billing and Budgets What to expect because a keen M1

Recording Personal debt

Of numerous college students have tried the fresh new AAMC’s MedLoans Coordinator and you may Calculator in order to organize advantageous site and you may song the funds throughout the years. Pages is also publish their federal financing guidance, run individualized cost situations, and you may help save financing payment options for later source. From the below video clips, Feinberg’s Cynthia Gonzalez takes you through the device step-by-step.

Cost Options

Once your government student education loans enter fees standing, you’ll favor among of numerous payment possibilities. The fresh new lower than video contours such selection in order to discover most useful decide to help you satisfy the debt management specifications. The fresh new AAMC has described repayment agreements getting government college students loans.

Financing Forgiveness Software

Regarding the below video clips, you will learn regarding the some loan forgiveness, grants and financing repayment direction applications, such as the National Wellness Services Corps, Indian Wellness Services, Public service Loan Forgiveness, the new army and other federal and state software. More in depth information about these financing forgiveness software is obtainable thanks to the newest AAMC.

A great deal more AAMC Resources

AAMC’s First (Monetary Guidance, Tips, Functions, and Units) provides totally free info to assist medical students make smart monetary conclusion regarding pre-matriculation owing to mortgage repayment. Check out the website to get more facts.

Feinberg’s Obligations Administration Conferences

Being professional-energetic in the finances can help eradicate stresses associated with profit. Our very own financial obligation administration counseling system, Lifetime $upport, was designed to encourage students to establish an excellent financial patterns for example as budgeting and examining credit continuously. Most courses become a working training component to let students acquire the basic event had a need to generate this type of activities. Talk about the list below of required and recommended sessions considering.

BYOB: Strengthening Their Finances (M1-Prior to Matriculation)

This-on-one course will become necessary for everyone entering children receiving school funding. Pupils is actually expected getting wishing and their support notification and you may a done AAMC interactive budgeting worksheet. Tips and you can expenditures was examined to choose in the event that mortgage funds is also feel returned.

Borrowing from the bank 101-Part step 1 (M1 Wintertime)

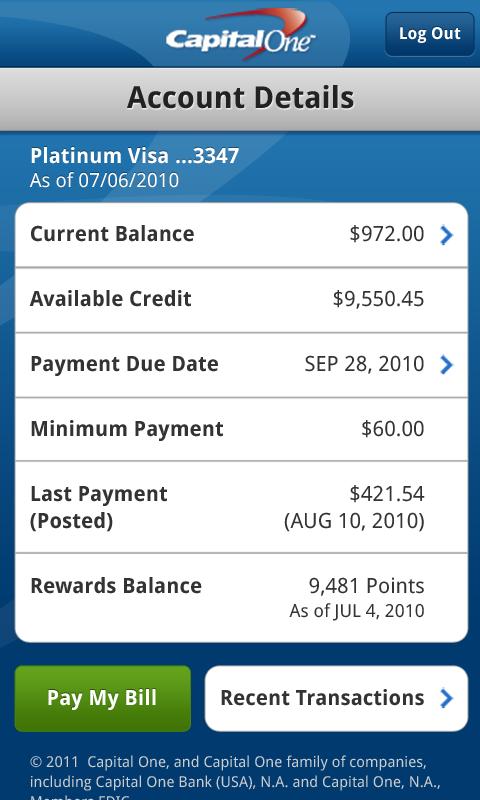

This tutorial will teach college students the basics in the credit. The goal of the latest concept would be to help students learn to create knowledgeable decisions on borrowing from the bank. In this course youngsters pull the credit file for comment.

Credit 101-Part 2 (M2 Slip)

The basics of Credit 101 was assessed. An easy way to safeguard borrowing is likewise safeguarded. The latest training usually avoid having college students pulling its credit history getting remark. The aim is to encourage pupils and make this for the an excellent financial habit.

It course facilitate college students finances and you may arrange for the newest following costs from what they can get within the M4 12 months because they get ready of residence app processes.

Personal Finance Resources (M4 Spring)

It tutorial is shown when you look at the M4 Capstone that is expected for everyone M4 college students. In the session, people might possibly be explore interactive gadgets to support cost management, W-4 income tax forms and you will credit.

M4 Required Education loan Log off Meetings (Three-Step Processes)

Settling loans should be stressful for anyone who’s not common which have financing cost selection. To combat this problem, all of the students which lent federal student education loans must complete a beneficial around three-step student loan log off processes from the Life $upport program.

- Step one: Observe AAMC Student loans and you can Fees Steps VideoStudents will discover new words and start to become used to the basics out-of mortgage repayment. That it foundation is vital to set up college students into expected that on a single education loan appointment. Pupils takes a working character by signing to your and you can posting mortgage record into the AAMC Coordinator/Calculator. That have a copy of your AAMC Obligations Director Guide is even of good use.

- Step 2: One-on-You to Loan Cost Fulfilling Children must meet that towards one to with Cynthia Gonzalez inside the AWOME to go over the loan collection. Cynthia can give attempt repayment schedules according to actual personal debt. The reason for this new training is for the latest college student to completely learn their fees possibilities. This may allow college students to create a strategy and place needs. Meeting options will be posted in the near future.

- Step three: On the web Counseling In the mid april, people get an email on Northwestern University Work environment away from Student Fund with an invite and you can advice out-of online guidance. It needs might be complete because of the a designated day, normally in early Will get. Within the online counseling, students will be required to determine a fees bundle. The plan chose are going to be altered. The goal would be the fact children might be happy to get this alternatives immediately following completing the original one or two strategies. Any questions or issues about this ought to be talked about from the one-on-that conference.

Should not waiting to know what is secured in the one-on-you to mortgage installment fulfilling? Cynthia Gonzalez will bring a general report about everything within films.

A home loan for Graduating Medical Students and you will Residents (M4-Winter)

Brand new AAMC has provided a noted an informational films regarding to buy a property. Shows are: deciding a great time to shop for and just how far you could pay for, renting as opposed to to find and budgeting to own a property.

Financial Think 101 (M4-Winter)

A guest presenter of MEDIQUS Asset Advisers Inc. often show information regarding earliest financial believe experience. Features were: building a monetary package, currency government and you may old age thought.