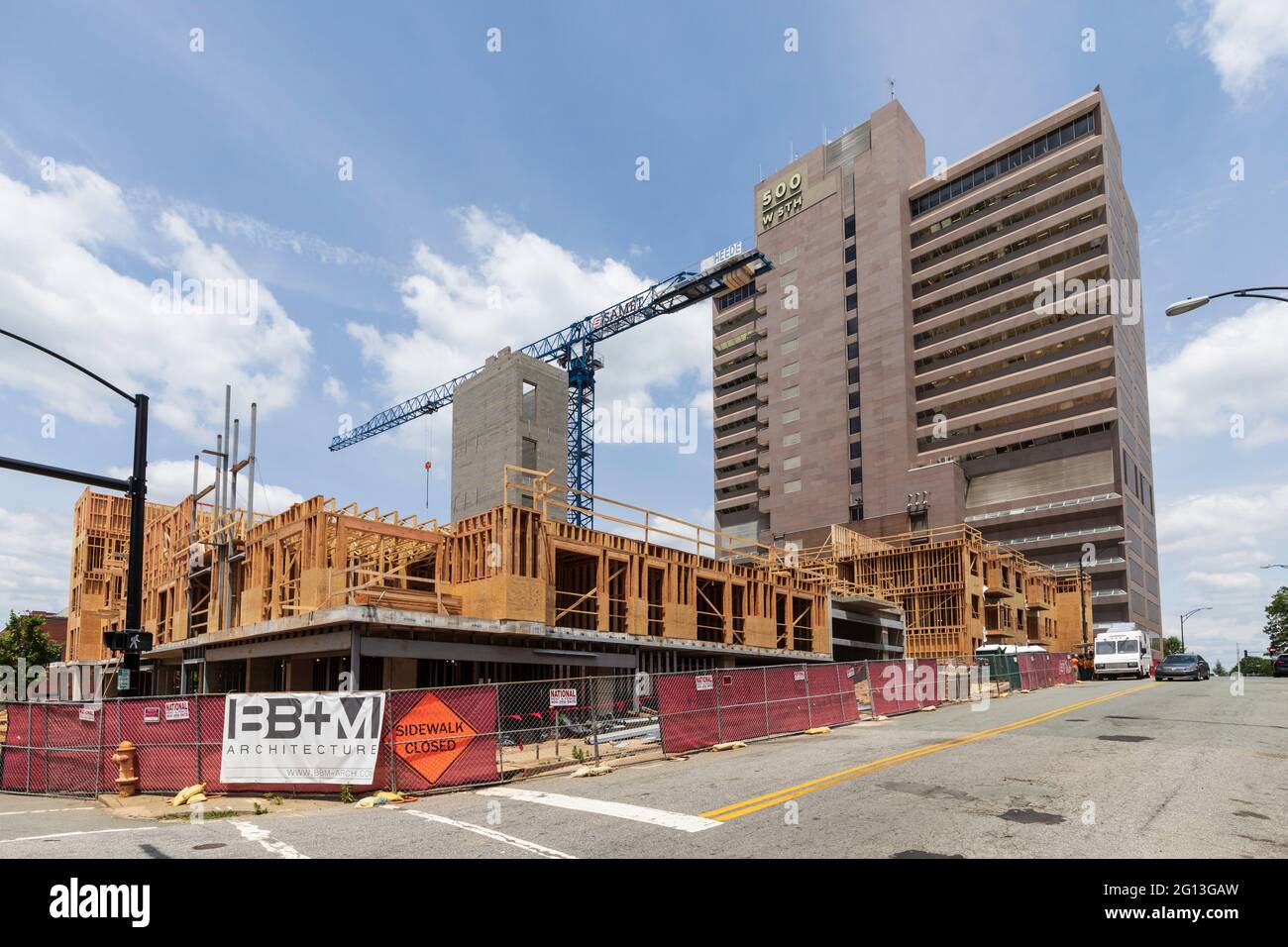

The pros and Cons out-of Individual Money Bridge Financing

Listed below are some our very own guide Connection Financing Versus Private Currency Financing [All you have to Know] to track down a more outlined explanation of the similarities and you will differences between the two.

Whether or not need quick cash so you’re able to inject in the fix and you can flip assets so you can simple more reple there are certain you should make sure before carefully deciding whether or not a personal money connection mortgage is right for you.

Advantages:

- No need to have a full time income statement Bridge funds off individual lenders are exempt from government laws and regulations one require you to give earnings papers or a credit history. Hence, the cash created from the purchases of present possessions can also be even be put toward trying to repay the loan.

- Versatile fees alternatives Individual currency lenders are accustomed to enhance and you will flip strategies not supposed because the originally arranged, otherwise an escape strategy getting longer than before computed. For the times such as these, repayments might be deferred, otherwise converted to a destination payment-merely plan up until the deals of a preexisting house is produced.

- Immediate access to loans As individual money bridge loans is really funded and covered from the new property’s worthy of, lenders don’t take into account your credit score. Because of this, they are acknowledged in a significantly quicker time than a classic mortgage. An average of, link loans from individual loan providers try analyzed and you can recognized inside doing 3-one week.

The new Drawbacks:

- Short pay-back window, high-rates Link fund routinely have high interest levels as compared to antique lenders, as well as the financing needs to be paid in a somewhat temporary time frame. Thus if you’re you’ll only need to spend the money for payday loans in Pembroke Pines interest rate getting a couple months till the mortgage are reduced, the interest can be higher due to the fact fifteen% or maybe more of your over loan amount.

- Increased exposure and you may financial obligation The fund incorporate a particular amount of risk; bridge funds are no difference. Occasionally, assets people usually split up the mortgage over one or two services. This is why, for a while, you will end up necessary to shell out two or three money right back all at the same time. This could put a strain on your estimated develop-and-flip funds. In addition, if difficult economic times hit, it could set you within the an emotional financial predicament.

- Additional charge and transaction will set you back From management, appraisal, escrow, and an origination commission is going to be added to a connection loan. New charges vary from state to state but can be as the highest as 15% of overall loan oftentimes. And you will pursuing the purchases off flipping property, of a lot assets people should expect to expend step 3-6% of the business speed to real estate professionals managing the exchange. This may clipped profoundly to the a keen investor’s profit percentage.

Is Link Loans Most effective for you?

Selecting the most appropriate variety of financing will ultimately rely upon the finances, overall mission, the state of the housing industry, as well as your geographical place. If you are searching to find the best capital choice for a remedy and you will flip, a struggling assets, or a rental assets that is not yet , earnings promoting, you’ll find that a private money link loan shall be more reasonable provider.

Something you should keep in mind whenever weighing in the pros and you may downsides of private money link financing is the fact there was a great risk in any version of economic exchange. It is trick you really have the small print and data at the front end people. By doing this, the chance is decreased and the chances of triumph including turning a distressed assets to own a neat funds was considerably maximized.