A classic re-finance, known as rates-and-label, is a great cure for decrease your interest and monthly obligations

Refinancing Your Mortgage

You may want to just be sure to switch this new terms of the mortgage if you haven’t created plenty of domestic security https://paydayloancolorado.net/julesburg/ but i have enhanced your credit rating and you can paid off almost every other costs.

Folks who are doing this kind of re-finance are not providing any currency aside, these include merely refinancing the balance he has in the a lesser rate, McBride states. New desire are appeal discounts, often by detatching its price and you can monthly payment or shortening brand new identity.

Where you’re planning into the swinging contained in this a couple of many years or you are not yes exactly how much expanded you are going to be in the house, it would not seem sensible to help you refinance because the you are probably perhaps not heading to earn right back the expenses of your own refinancing, McBride states.

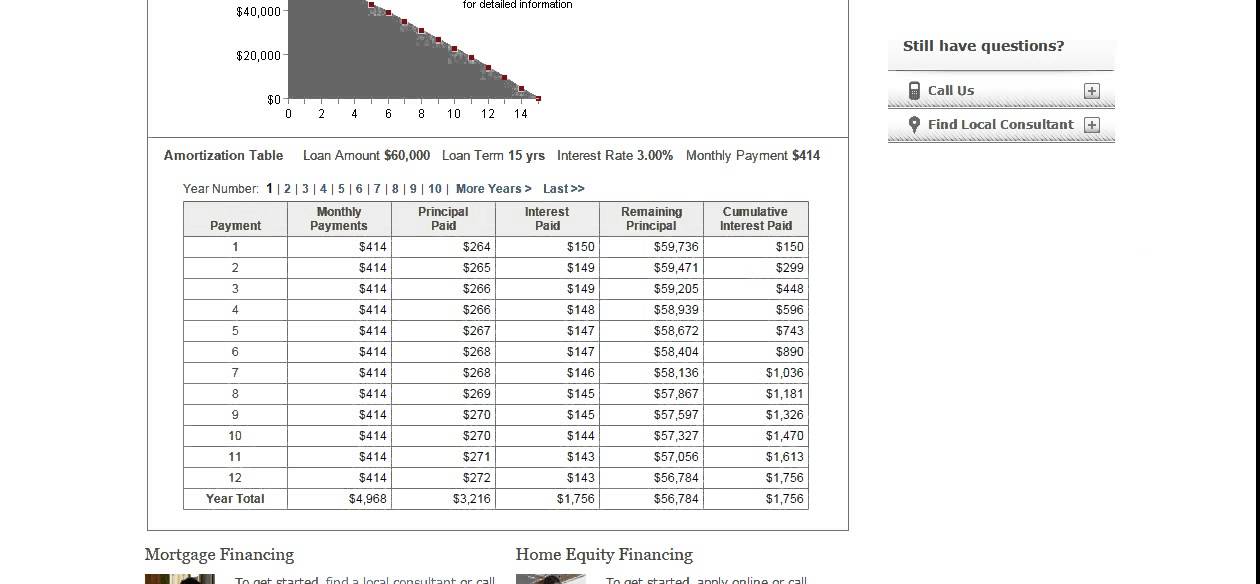

For example, should your charges are $4,000 nevertheless the yearly notice discounts was $step one,000, you will need to stay static in your property for around five decades to pay off the charge and five years to start seeing offers and you will a reduced amount of their principal.

If you plan to stay static in your property for a lengthy period additionally the fees was manageable, you could potentially lower your total can cost you because of the plenty and lower the payment by the a lot of money.

FHFA Refinancing Alternative

This is exactly a new selection for reduced-earnings individuals just who have not been capitalizing on low interest rates. The program, which had been been the 2009 season by Government Construction Finance Institution (FHFA), helps you to save qualified individuals $step one,2 hundred to $step 3,000 a year, the fresh new agencies claims.

A year ago noticed an increase from inside the refinances, but more than 2 million reasonable-earnings group failed to enjoy the listing lower home loan rates of the refinancing, told you new FHFA’s manager, Mark Calabria.

Haven’t any missed payments in the earlier six months, and no more than one overlooked fee in the last 12 weeks.

N’t have a home loan with that loan-to-well worth ratio greater than 97 per cent, a debt-to-income proportion significantly more than 65 %, or an excellent FICO score less than 620.

Underneath the system, lenders gives a cost savings with a minimum of $fifty on borrower’s monthly mortgage payment, as well as the very least half of a percentage point loss in the new borrower’s rate of interest.

Individuals also can get a maximum $five hundred credit regarding bank to own an assessment once they are not eligible for an assessment waiver. They won’t be required to afford the upwards-front adverse sector re-finance percentage if the their financing stability is at otherwise below $300,000.

Mortgage loan modification

Rather than refinancing your home loan, a lender could possibly get commit to brand new conditions one decrease your monthly fee to a cost you can better pay for, according to User Economic Shelter Bureau. Known as that loan amendment, new contract could possibly get extend the amount of years you have to pay the mortgage, lower your interest, postpone otherwise impede your percentage (forbearance), otherwise lower your dominating balance.

With respect to the Experian borrowing from the bank bureau, financing amendment is intended for those who are incapable of keep up with mortgage payments and therefore are trying an effective way to stop property foreclosure. To qualify for an amendment, a borrower will be able to reveal that its finances has changed rather, so it is tough to make the decided-through to repayments.

If you’re more lenders keeps other standards getting financing changes, Experian claims one for most, so you’re able to be considered you must be a minumum of one regular homeloan payment at the rear of or show that shed a payment is actually imminent.

You’ll also probably need to prove tall financial hardship. For example enough time-term infection otherwise impairment, death of a close relative (and you may loss of their income), struggling with a natural or announced emergency, the newest uninsured loss of assets, a sudden boost in homes costs (also nature hikes from inside the possessions taxation or homeowner connection charges), and split up.