USDA Launches Guidance Circle to support Financially Troubled Farmers and you will Ranchers

The latest You.S. Institution out of Agriculture (USDA) try proclaiming the brand new launch of brand new Troubled Consumers Assistance System, an effort made to bring individualized service so you’re able to economically disturb growers and you will ranchers across the country. Courtesy a series of Cooperative Agreements, it federal community tend to link distressed individuals that have personalized assist with assist them to stabilize and win back economic footing. USDA’s Ranch Solution Institution (FSA) produced so it statement Tuesday in the Ranch Support Festival from inside the Saratoga Springs, Ny.

We been my of-ranch industry given that a ranch Recommend, performing give-in-hands with other tireless character advocates. Having someone having experience in the ag fund let firms sort out financial difficulties could possibly be the difference in all of them dropping the brand new farm or successful, said FSA Administrator Zach Ducheneaux. New Disappointed Consumers Advice Community underscores our very own dedication to farmers and ranchers finding brand new tailored help they require. Such partnerships as well as instruct you to USDA understands the importance of such advocates and observes all of them included in the option to be certain that system availability for everyone producers, ranchers, and you may suppliers.

Community partners is Ranch Support, Rural Development Base Worldwide, the fresh School away from Arkansas, the Socially Disadvantaged Farmers and you will Ranchers Policy Heart in the Alcorn State School, together with School off Minnesota. From this step, we are working together that have society-oriented communities to higher suffice economically distressed brands.

FSA, in collaboration with farm assistance teams and you may house-grant organizations, usually assists so it network, that may deliver the tech info and you will pointers of USDA people so you’re able to benefits away from disappointed and you will underserved groups. New network’s method has partnering experienced service providers to transmit one-on-one help in order to consumers so they can ideal generate arrangements and understand choices to defeat the monetary demands.

New Troubled Consumers Advice Community commonly address the newest instant requires away from distressed individuals and supply total, wraparound attributes aimed at dealing with exclusive demands encountered because of the economically troubled firms. Just after stabilized financially, such individuals would-be greatest positioned to get into new possibilities and you will continue leading to new agricultural savings. These types of assets might build a system out of suppliers one is also best support agricultural communities for a long time. Committing to a system off agricultural funding providers to assist bridge use of FSA finance are a benefit for rural and you can agricultural teams.

FSA recently announced tall transform to help you Ranch Loan Programs from Improving System Availableness and Birth to possess Farm Fund code. This type of rules transform, when planning on taking feeling Wednesday, Sept. twenty-five, are created to grow potential to have consumers to boost earnings and you may be much better ready to create strategic opportunities when you look at the improving or growing their agricultural functions.

The mortgage Advice Tool that provides consumers which have an entertaining on line, step-by-step help guide to identifying the newest direct financing products that will get complement the company need and to understanding the software procedure.

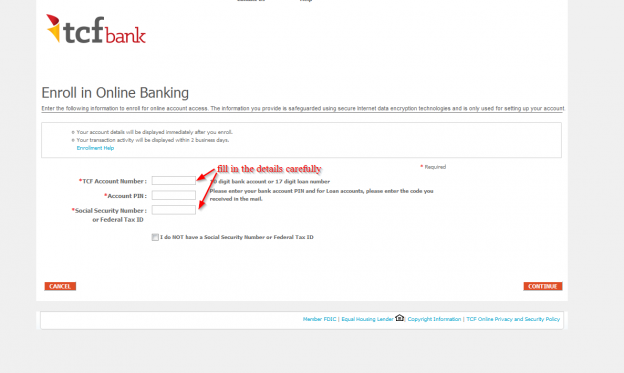

The web based Loan application, an entertaining, guided application which is paperless and offers of good use have and additionally a keen electronic trademark choice, the capability to mount help data files like taxation statements, payday loans Moores Mill complete an equilibrium piece, and construct a farm doing work bundle.

FSA likewise has a critical effort underway to improve and you can speed up the newest Farm Mortgage System customer-up against company processes

An on-line direct mortgage fees ability you to relieves individuals from the need of contacting, mailing, or checking out a neighborhood USDA Services Center to invest financing installment.

Circle partners offers farm mortgage rules knowledge into the people-established communities so that the organizations can work close to FSA to greatly help suppliers discover money offered compliment of FSA, making sure after they head to an FSA office, the mate team member and you can FSA group can top let

USDA encourages firms to reach over to its local FSA ranch mortgage professionals to ensure they grasp the range loan and make and you may upkeep available options to simply help that have doing, broadening, or keeping the farming procedure. So you can conduct business having FSA, companies should contact its local USDA Solution Center.