How exactly to Be eligible for a keen FHA Mortgage Immediately following Bankruptcy

Editorial Guidelines

If for example the homebuying preparations was basically put on keep on account of good bankruptcy proceeding, take cardiovascular system: You are able to be eligible for an FHA mortgage why not check here after a case of bankruptcy one could have been released over the last a couple of years. Even in the event a case of bankruptcy may stick to your credit history having seven so you’re able to a decade, FHA recommendations allows you to be eligible for financing fundamentally, dependent on if you recorded a chapter 7 or Chapter 13 case of bankruptcy.

- Steps for taking so you’re able to be eligible for an FHA financing immediately after bankruptcy

- 5 ideas to alter your earnings immediately following personal bankruptcy

- FHA loan conditions

Measures when planning on taking so you can be eligible for a keen FHA financing immediately after bankruptcy proceeding

The guidelines getting qualifying to own an FHA financing immediately following bankruptcy proceeding are very different considering what kind of bankruptcy proceeding is released. There have been two type of bankruptcy open to some one, and every is sold with its very own guidelines for getting an enthusiastic FHA financing.

A bankruptcy proceeding

After you file a section seven bankruptcy, all your valuable property can be bought therefore the continues are widely used to spend loan providers and you will dump the eligible personal debt. It’s the most commonly known type of bankruptcy proceeding that is an educated choice for people that lack sufficient earnings to repay the bills.

Youre qualified to receive yet another FHA financing two years just after your bankruptcy proceeding are discharged. A good discharge is actually a judge purchase one releases you from the fresh new costs integrated on the bankruptcy proceeding, and the date stamp to the launch begins the brand new clock with the your wishing period. You ought to in addition to satisfy a few almost every other requirements together with the waiting several months:

- You’ll want re-mainly based a good credit score. Lenders will pay close attention so you’re able to just how you may be handling borrowing after a bankruptcy, especially their latest fee records on people the new personal debt and just how much the fresh loans you take towards.

- You ought to explain the cause for this new case of bankruptcy. A page of explanation is normally called for therefore, the bank is know very well what happened and how stuff has changed financially towards top while the bankruptcy was discharged.

You can qualify for FHA investment 12 months after a case of bankruptcy launch, as much as possible establish the fresh new bankruptcy proceeding was as a result of factors beyond your own control. The latest FHA phone calls this type of extenuating affairs, and are:

- The brand new death of a salary-earning companion

- Serious infection

- Taking let go

- Sheer crisis you to definitely ruins your entire property

Part 13

A chapter 13 personal bankruptcy was designed to offer those with a great uniform money a legal-ordered payment plan. Whenever a chapter thirteen is filed, the person (titled a borrower in cases like this) works together with a beneficial trustee to settle financial institutions towards the a plan over an excellent about three- to four-12 months several months. If fee bundle is carried out, people left qualified costs are released.

To acquire a keen FHA mortgage, you have to show you have made on the-big date money to the Section thirteen arrange for a minumum of one seasons. The lending company will demand documents to exhibit new payment dates and you can you’ll need written consent in the judge to apply for the fresh mortgage.

Things Should be aware of

This new Federal Construction Administration (FHA) backs money created by FHA-recognized lenders so you’re able to consumers which have lower credit score minimums and being qualified criteria than traditional fund allow. This is accomplished of the billing FHA home loan insurance rates, that’s paid back from the borrower to guard loan providers facing loss for many who default and they have to help you foreclose. Individuals commonly prefer FHA funds after a bankruptcy proceeding due to the fact several-year waiting several months is less versus four-year prepared period required shortly after a case of bankruptcy to possess antique fund.

5 ideas to replace your cash after bankruptcy proceeding

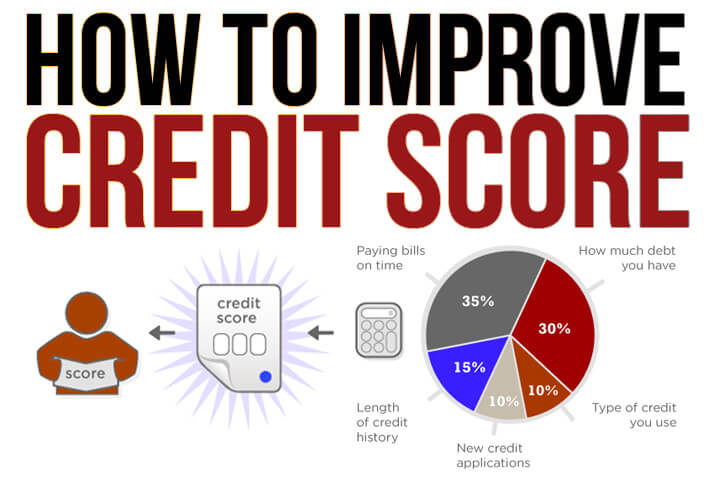

As well as appointment the minimum wishing symptoms, you’ll want to tell you the financial institution debt residence is when you look at the purchase to meet this new re-mainly based good credit tip. Personal bankruptcy have a large affect your own fico scores, nevertheless the the quantity of your own destroy depends on your general borrowing from the bank profile.