Just how Their Matrimony Contract Impacts Their Bond Software

Wedding try a professional public traditions which can alter your lives together with lifestyle you end up lifestyle. It does change the second from the affecting your judge condition – switching from their title inside papers towards permissions needed away from you along with your lover when entering into contracts going forward.

The relationship position matters, as there is certainly a go you’re going to tie the knot specific go out. When you find yourself Southern Africa’s nonetheless spotted more 106 000 municipal classic marriage ceremonies entered, with the person with average skills marrying within their thirties and over 80% regarding e go out, not all marriage ceremonies past, that have five regarding 10 marriage ceremonies ending inside separation in advance of its ten year anniversary.

Thus there’s a go you might start otherwise prevent a marriage if you find yourself navigating your house ownership techniques, hence your position (regardless if you are getting into, in, or conclude a customary or civil relationship) will receive consequences on your own capability to buy a property or funds the acquisition.

In case your marriage ceremony pertains to strolling off an aisle, investing lobola otherwise breaking mug, you will need to have the relationship recognised because of the South Africa’s Company away from Family Points. This will ensure the relationships complies having any courtroom conditions or ante-nuptial contracts applicable, whether it’s a civil wedding, a good custoe sex partners.

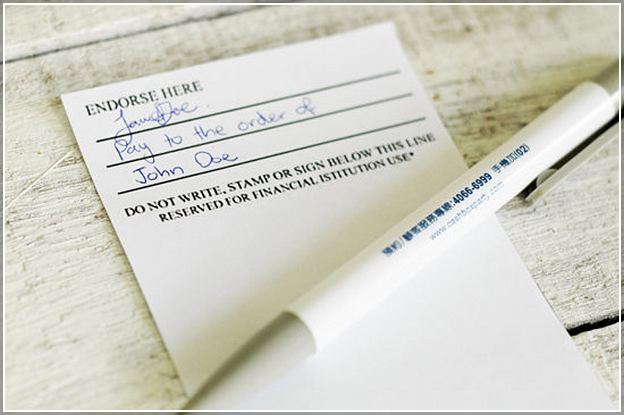

You’ll find around three sorts of wedding deals you might get into that may apply at their thread applications and you will then property instructions or conversion. The foremost is matrimony when you look at the area out of assets. Which default option sees the happy couple consolidating its present assets, which have any biggest purchases generated just after wedding demanding both parties’ concur. In the event that you to find otherwise promote a property bought throughout the this time around, you need permission from your own lover. The only exclusion could be possessions your directly keeps passed on otherwise commonly inherit that accompanies courtroom stipulations stopping you against sharing possession having another person.

The following type of wedding deal you might enter into is actually outside community’s property. This involves one to sign an enthusiastic ante-nuptial bargain to safeguard your property and happen in place of accrual, and thus the person property and you will sales your physically and acquire in the years ahead remain separate.

The past variety of contract you could potentially go into are external off community away from assets but with accrual. This can discover all property the two of you purchase just after marriage thought shared orders which have joint possession unless of course clearly excluded, with all of possessions accumulated during the relationship being split similarly if the relationship prevent.

If you married around conventional rules from inside the an African or Muslim service, you might be capable put an enthusiastic ante-nuptial bargain in position depending on if you were partnered just before or following Recognition from Custo. If you got hitched lower than traditional law after that big date or got hitched away from South Africa, this could also impact your home possession updates. When in doubt, it is best to look at your bargain otherwise certificate to have clearness.

Exactly how additional matrimony agreements perception their reputation

- Create I want to carry on everything?

A marriage can be evolve through the years. Although you will start the connection that have both sides doing work and generating a similar salary, you to definitely partner you’ll feel unexpected paycheck expands or ily,anyone might need to stop working altogether or cut back on their working days for several years. When this occurs, their monetary efforts can disappear, even though they sign up to the household various other suggests. For those who wed from inside the people regarding possessions, you should be ready to accept them to keeps courtroom ownership out-of your home, even when, strictly speaking, they failed to pay money for fifty% from it.

- Create We have pre-current possessions?

An individual may have been in riches one to they will have generated courtesy an enthusiastic separate money in the way of possessions. They are able to and inherit loans Westminster CO property on the newest passage through of a household associate, toward aim of passing it down to further years. If it applies to you, wedding outside of neighborhood out of possessions is a much better suggestion. It does make sure that your assets are nevertheless the, and that’s especially important in mixed friends situations where your otherwise your spouse have pupils out of previous relationships. Getting married which have accrual normally verify people assets both you and your partner buy is as you separated ranging from you a couple of if the matchmaking prevent, as opposed to decreasing pre-existing assets you have earmarked for the physical children.

Just how wedding influences your credit rating

If you would like buy possessions with your spouse inside the a good shared choice, your own thread application will imagine your because co-people in one app. It indicates they evaluate the shared economic records and riches whenever it comes to the loan recognition, rate of interest and you will repayment words. Although cutting-edge activities could affect exactly how lenders get this to choice, your private credit ratings can impact your exposure. There’s absolutely no single best rating to operate for the, you ought to know you to definitely a major discrepancy involving the credit score plus lovers you can expect to increase flags together with your application, resulting in waits if you don’t rejections. Understanding the standing off each other your own borrowing pages before you apply getting a bond can help you finest ready your means.

Getting married might be one of the happiest days of their life and thus should the go out which you get your earliest domestic, regardless of character of your layered and you may fret-free to, SA Mortgage brokers makes it possible to prepare for a bond software and you will browse your house control processes. For connecting with us, label 0860 2 4 6 8 ten today or consult good Call me back.