All you have to See Before you apply for a mortgage loan

Obtain the newest reports from LMCU

Spring has arrived plus the housing industry are booming! Purchasing a new home is to the many people’s brains, maybe even your very own. One which just jump base-earliest to the real estate procedure, you can even earliest learn about what is actually involved when using and being qualified having a home loan.

While getting ready to get your first family, you can make the process simpler of the training around you might regarding the mortgage techniques before you can pick your ideal home. Knowing what you may anticipate allows you to plan ahead and certainly will assist you in finding the mortgage system you to definitely most useful fits your financial state.

Display screen Your credit score

A very important factor when you look at the obtaining a home loan is the credit rating and loans percentage record. A decreased credit score ount of money you might use once the well because the possibly impact their rate of interest. Which have good credit is a big advantage. This may will let you be eligible for a lower interest rate, potentially helping you save several thousand dollars along the longevity of your loan.

In the event your get is leaner than just you forecast, there are certain things you can do to improve they. Paying obligations and you will using any costs promptly commonly improve the most. Do not start people this new account and take for the this new loans when you look at the mortgage software process. When you yourself have paid off their credit cards, keep the cards open, dont close them.

Unless you understand your credit rating and you may would love to understand before applying for a financial loan it is possible to look at the credit rating on the around three biggest credit bureaus (TransUnion, Equifax, and you can Experian). To learn more about exactly how your credit score performs a job on financial processes, read all of our blog post right here.

Learn The debt-to-Earnings Proportion

Your debt-to-earnings ratio is an essential part to help you choosing how much family you can afford. Recognized throughout the mortgage industry given that a DTI, it shows new percentage of their monthly money that goes to monthly loans money. Whenever obtaining home financing, their DTI would-be examined together with your credit, a position records, money and you may guarantee.

In order to assess their DTI, take your complete monthly premiums (ex: auto repayments credit card debt, figuratively speaking) and separate one amount by the gross, money. Maximum DTI proportion was 43% even though there are conditions in which this may increase.

Cut, Save, Rescue

When you see your house-to buy procedure, you need to initiate rescuing having a deposit. Depending on your loan program you will need as low as 3% having a down payment. A larger advance payment may help reduce your rate of interest.

Having some extra savings kepted you will will let you put a deal more price tag to better your chances of delivering our home you’ve fallen crazy about. For many who put a deal above the selling price, and also the home cannot appraise you to large, you’ll want to afford the difference in cash out of your pouch.

In addition for those who have 20% or maybe more because a deposit, you will not be required to spend private home loan insurance rates (PMI), which will decrease your monthly payment.

Start Collecting the necessary Documents

Before you go to begin https://paydayloanalabama.com/walnut-grove/ with the program process, it is best to their paperwork already built. Some of the data you happen to be needed to provide is: your income stubs over the past week, the tax returns on the past 2 yrs, and two months’ value of bank statements. You’ll also be asked to file where your own down-payment financing are on their way off. Should it be away from coupons, a retirement membership or present funds from a reasonable origin their Loan Administrator allow you to know what make an effort to promote.

Score Pre-Acknowledged

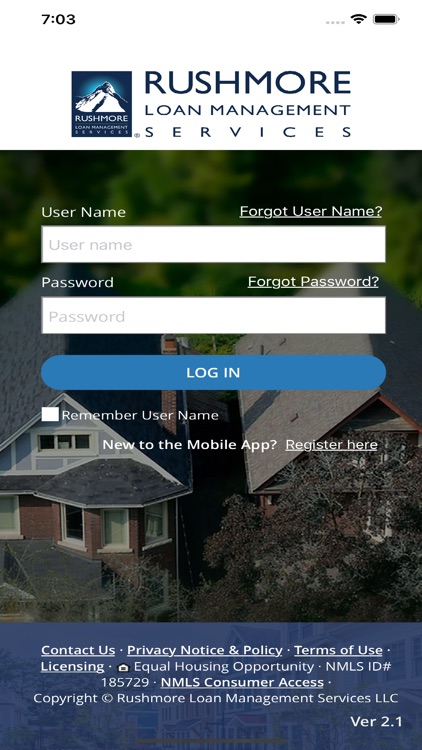

Prior to going considering homes, it is important to contact a LMCU Financing Manager and also pre-approved getting a mortgage loan. That it pre-acceptance allow you to recognize how much you be eligible for so considering the proper proportions and charged home. It also suggests manufacturers and realtors that you’re big, qualified, and able to close on the a house, and work out your own offer more powerful and you will potentially more appealing.

Look for That loan Officer

Of taking your pre-certified, to walking you throughout the mortgage techniques, financing officer can help you reach your monetary goals having financing program that fits your circumstances. Your loan officer is there to provide the options, explain costs and charges together with take you step-by-step through the latest whole process. Working with a great LMCU Loan Manager will give you the confidence your putting some correct ily.

Homeownership is a significant resource, and it’s really a not merely one-size-fits-every procedure. Luckily, our very own LMCU loan officers provide the fresh new assistance and you will provider required to make your residence to shop for dream a reality.