However, lender costs are confidential to them

However, there are will set you back doing work in breaking any deal. To start with you need the other party’s concur. Of course, if they offer they, they would need any will cost you he is enjoys shielded.

This new Zealand legislation demands finance companies to allow a mortgage fixed price package to get broken. But it addittionally constraints them to just curing will set you back, rather than ‘profiting’ on deal.

When interest levels is shedding, consumers usually need to prevent its highest-rates contract in preference of a lower speed one to.

However, though cost is actually ascending, there clearly was reasons why you should crack a fixed price package. You might have to all of a sudden promote the root assets (owing to a romance break-up, or even relocate to the fresh new work in another urban area otherwise nation, like).

Only the lender alone can give you specific quantity

The nation is changing fast and now we now you prefer their service more than ever before. Top quality journalism is costly along with these very troubled times all of our offer income are becoming very not sure. We offer our publicity free to readers, of course you worthy of one http://www.simplycashadvance.net/personal-loans-or/, we inquire you Feel a promoter. To do that, both click the Red-colored key below, otherwise towards the Black key towards the top of this site. The degree of your support is up to you. Thank you so much. (When you are already a supporter, you are a champion.)

This new limit you to banking companies try not to profit from the order sets a beneficial clear edge on which is involved. Most would not also provide its prices legs fundamentally, despite the fact that gives specific dated info to help you individual people.

Government entities therefore the Ombudsman possess each other addressed this matter and you will advised how this type of purchases is to performs. We play with changeable formulas according to financial you’ve chosen, for how they have announced how they create these calculations. (But we possibly may not have the exact formulas since not all the ones are entirely clear about this detail.)

This calculator makes an estimate. Our estimate understands new bank’s price of currency according to general exchange pricing additionally the change involving the begin time partnership you have made into the brand spanking new label, and you can good recalculation according to research by the modified avoid date. I include the fresh new bank’s fees for this version of exchange.

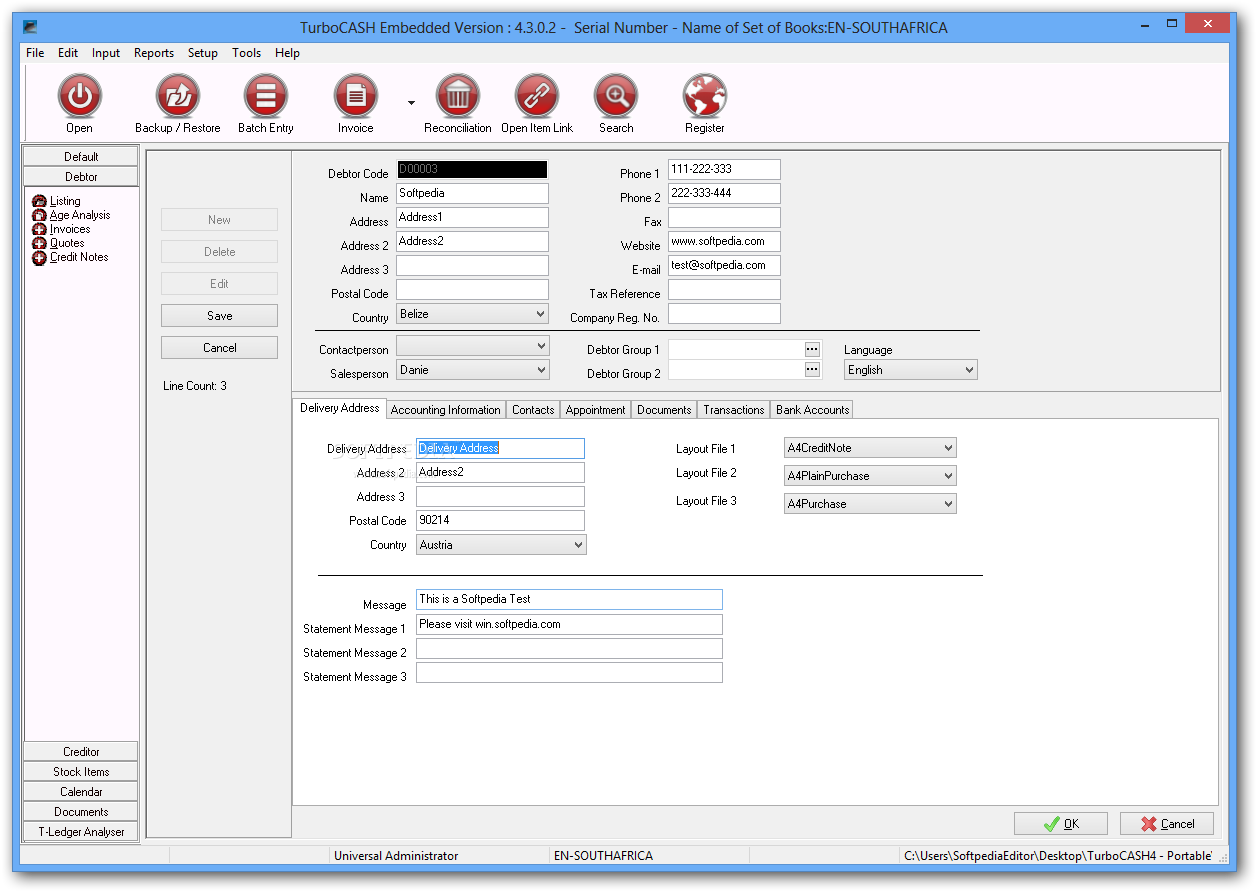

We are in need of one to enter into all white areas for your mortgage

Your normal payment count is one of them, although calculator commonly recommend the minimum that’s attending feel appropriate (to own an everyday dining table mortgage). (You can find mistake examining limitations as well as the restrict can only just end up being exactly how much you have to pay so you can may it well from inside the the present day repaired speed several months.) The standard money from the beginning is assumed to get the brand new simply money you made. When you yourself have made a little extra payments, the outcomes of this calculator may not be valid. Furthermore, when you yourself have arrears, the outcome less than might not be good.

Particular banking companies may use another type of base on the one we are of course, if they use, and additionally which can offer a separate address. The brand new variation will be somewhat brief however. If it is not, delight tell us and we will reevaluate just how it calculator works best for that lender. Do not use so it calculator to sort out an outcome. Merely the financial does one. That it calculator could only supply an offer. It generally does not be the cause of any extra payments you have produced in the process.

Cost (including exchange pricing) can change rapidly, and you can numbers must be calculated towards actual date the very early payment is made.

The management of exchange rates, such as for instance in which there’s not a precise suits, involves a substantial amount of performs and you will is not always some thing i have a tendency to take precisely in this product, therefore it is crucial that you understand that it product isnt an enthusiastic perfect meets about what the lending company create determine.

Brand new calculator begins that have standard opinions for all fields, you ought to changes them to suit your financing. There are minimums and maximums for everyone fields considering just what very mortgages seem like. You will be informed for people who violate some of these limitations. And additionally, there are inspections from the calculator so as that the fresh new inputs joined from you create a valid mortgage. Otherwise, the new calculator tend to alert you. Please understand these types of alerts to fix the fresh inputs to guarantee the enter in parameters portray a legitimate mortgage.