A houses Loan Supported by government entities

Brand new FHA You to definitely-Time Romantic Loan are a safe, government-supported financial program available for you to-unit, stick-situated first homes, the newest are produced casing having first homes (no wide mobile property), and modular property. It allows consumers to invest in with the design, package purchase (if necessary) and you can permanent financing toward you to definitely mortgage and you may an individual closing most of the immediately with the absolute minimum down payment out-of step three.5 % (up to the latest FHA condition financing limitations).

Very build funds need one or two separate closings-once to help you be eligible for the construction itself, and you will again whenever transforming to the a permanent financial. In the event the builder gives the clear to shut on property and it’s really time for you move in, the customer should pay off the construction mortgage and implement to have yet another mortgage. Such typical design finance have one or two closure schedules, and require the brand new homebuyer to help you requalify which have borrowing checks, confirmation out of a job, most settlement costs, etc.

One-Go out Romantic Loan provides consumers another type of solution. New FHA guide, HUD 4000.step 1, means that it just like the a beneficial construction-to-permanent financial. It is one financing, with one single closure time, and an exact gang of variables based on how the loan was to help you go-ahead inside design phase and you may beyond. An enthusiastic escrow account is needed to pay the expenses out of construction and relevant costs, and also the borrower may not be obligated to build mortgage payments up until a designated time pursuing the finally inspection of the finished really works (usually inside 60 days).

Preparing

All the FHA points have a similar needs, but lenders can be put guidance and additionally those people minimal FHA conditions. Plain old advice for without any late or skipped costs 1 year prior to your property loan application is appropriate in this instance. To prepare having a houses financing, its good to strive toward cutting financial obligation-to-money rates, end trying to get the latest lines of credit, and you can absorb your credit history to get rid of delays on account of mistakes, dated advice, or any other troubles.

Require More information On You to-Date Romantic Loans?

I’ve over detailed search toward FHA (Federal Houses Management) and also the Va (Department of Pros Points) One-Day Intimate Framework financing software. I have verbal directly to authorized lenders one to originate this $5k loans Rollinsville type of home-based financing sizes in the most common states and every company have provided you the rules because of their circumstances. We could link your that have home loan officials who do work to possess lenders one to know the equipment well and possess consistently offered high quality services. When you’re interested in are called by an authorized lender in your area, excite send responses to your concerns less than. The information is treated in complete confidence.

FHA provides pointers and connects customers to help you certified One to-Time Close lenders to boost feel regarding it mortgage unit and you will to aid customers discovered top quality solution. We’re not taken care of promoting or indicating the lenders or mortgage originators plus don’t if not take advantage of doing so. Customers is always to look for financial attributes and you will examine its selection before agreeing so you can just do it.

Take note that buyer recommendations towards the FHA and Virtual assistant You to definitely-Big date Romantic Framework Program simply enables unmarried family members dwellings (step 1 tool) – rather than for multiple-nearest and dearest systems (no duplexes, triplexes otherwise fourplexes). Additionally, another residential property/building styles are not welcome lower than these software, together with although not limited by: Equipment Property, Barndominiums, Cottage Property, Shipments Container Residential property, Stilt Belongings, Solar power (only) otherwise Wind Pushed (only) Land, Dome Land, Bermed World Sheltered House, Lightweight Home, Connection Dwelling Systems, otherwise A-Framed Residential property.

E mail us: Send us Your own Demand – Junk e-mail Secure

Delight send the email demand to [email secure] which authorizes FHA to talk about your personal information that have one to mortgage bank licensed towards you to get hold of you.

Your email to [current email address protected] authorizes FHA to share with you a advice with a home loan company licensed towards you to contact you.

- Upload very first and you can last name, e-mail address, and contact telephone number.

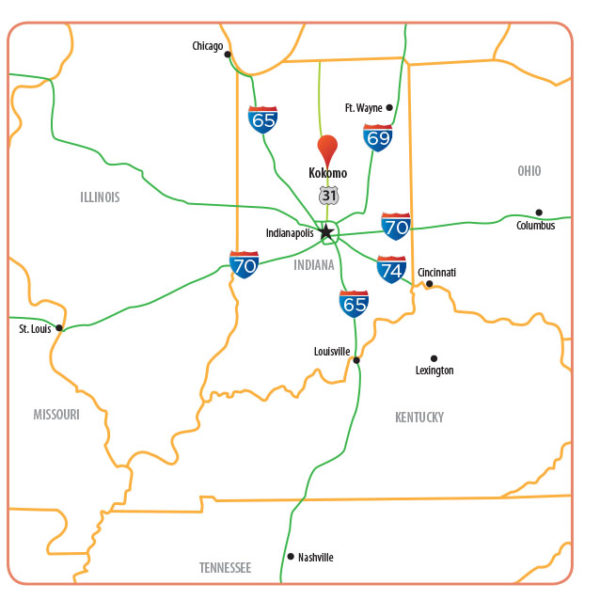

- Let us know the town and you can condition of proposed assets.

- Inform us the and you will/and/or Co-borrower’s credit reputation: Advanced – (680+), A great – (640-679), Fair – (620-639) or Worst- (Below 620). 620 is the lowest qualifying credit history for this unit.

- Are you presently otherwise your wife (Co-borrower) eligible experts? In the event that often people meet the criteria veterans, off money only $ount your debt-to-income ratio enable for each Virtual assistant assistance. Whenever you are there are not any limitation financing number, very lenders will go as much as $step one,000,100 and you may review high financing number for the a case-by-situation base. Otherwise, this new FHA down-payment is 3.5% up to maximum FHA financing restrict to suit your state.