Understanding Forex Trading Systems Strategies for Success 1791074266

Understanding Forex Trading Systems: Strategies for Success

In the ever-evolving world of forex, having a reliable trading system is crucial for success. A trading system provides a structured approach to trading, allowing traders to make informed decisions based on historical data and analytical tools. This article will delve into the basic concepts of forex trading systems, their components, types, and tips for creating a successful strategy. Additionally, we’ll advise you on how to choose the right broker for your trading needs. If you’re interested in a reliable broker, check out forex trading system Trading Broker Global for your trading journey.

What is a Forex Trading System?

A forex trading system is a set of rules and procedures that traders follow when entering and exiting trades in the foreign exchange market. It can be simple or complex, depending on the goals and style of the trader. The primary objective of any trading system is to generate profits consistently over time. A successful forex trading system involves comprehensive market analysis, technical and fundamental indicators, and effective risk management strategies.

Key Components of a Forex Trading System

Developing a strong forex trading system involves several components:

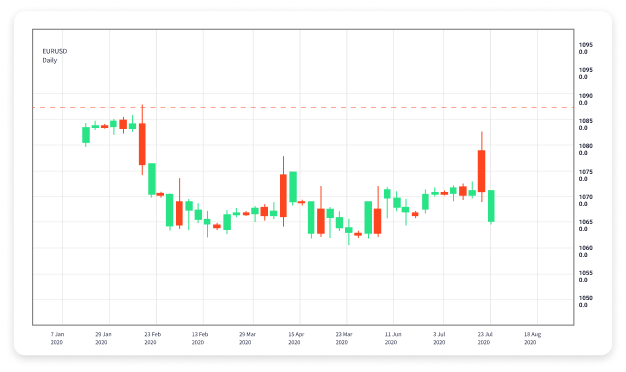

- Market Analysis: Traders use both technical and fundamental analysis to understand market trends and predict potential price movements. Technical analysis involves studying price charts and indicators, while fundamental analysis focuses on economic reports and geopolitical events.

- Entry and Exit Strategies: This part of the system defines when to open and close a trade. Traders typically set criteria based on price levels, indicator signals, and other factors.

- Risk Management: Effective risk management is vital to protect capital. This includes setting stop-loss orders, determining position size based on account size, and identifying risk-reward ratios.

- Performance Evaluation: Periodically reviewing the results of your trading strategy can help identify strengths, weaknesses, and areas for improvement.

Types of Forex Trading Systems

Forex trading systems can generally be categorized into several types based on the trader’s methodology and style. Here are some common types:

- Scalping: This strategy involves making many small trades over short periods, aiming to capture tiny price movements. Scalpers often rely on technical indicators and live price data to make quick decisions.

- Day Trading: Day traders open and close positions within a single trading day, avoiding overnight exposure. They typically focus on high-volume currency pairs and use technical analysis to spot opportunities.

- Swing Trading: Swing traders aim to capture longer-term moves in the market, holding onto positions for several days or weeks. This strategy requires a solid understanding of market trends and often incorporates both technical and fundamental analysis.

- Position Trading: Position traders take a long-term approach, holding positions for months or even years based on economic fundamentals and trends. They usually rely on macroeconomic indicators to guide their decisions.

Creating Your Forex Trading System

Now that you understand the key components and types of forex trading systems, the next step is to create your own. Here are some tips to guide you:

- Define Your Trading Goals: Establish clear objectives for your trading journey. Consider factors such as risk tolerance, desired profit margins, and the time you can dedicate to trading.

- Choose a Trading Style: Decide which trading style fits your personality and schedule. Whether you prefer short-term scalping or long-term position trading, ensure that your chosen method aligns with your goals.

- Research and Test Strategies: Before implementing a trading strategy, conduct thorough research on various techniques. Utilize demo accounts to test strategies without risking real capital.

- Monitor Economic Events: Stay informed about news and events that could impact currency prices. Economic releases, geopolitical events, and central bank announcements often lead to increased volatility in forex markets.

- Keep a Trading Journal: Document your trades, including entry and exit points, the strategy used, and outcomes. Regularly analyzing your trading journal can help you identify successful patterns and areas needing improvement.

Choosing the Right Forex Broker

Having a reliable forex broker is crucial for the success of your trading system. Here are some factors to consider when selecting a broker:

- Regulation: Ensure that the broker is regulated by reputable financial authorities to protect your funds and guarantee fair trading conditions.

- Trading Platform: Choose a broker that offers a user-friendly trading platform with necessary tools, charting capabilities, and access to various currency pairs.

- Trading Costs: Compare spreads, commissions, and fees to ensure that the broker’s cost structure aligns with your trading style and strategy.

- Customer Support: Reliable customer support is essential for addressing any issues that may arise while trading. Look for brokers that offer prompt and helpful assistance.

- Account Types: Some brokers offer different account types tailored to specific trading styles or experience levels. Assess which account type best suits your trading needs.

Conclusion

A robust forex trading system is essential to navigate the complexities of the global forex market successfully. By understanding market dynamics, defining your trading strategy, and maintaining a disciplined approach to risk management, you can improve your likelihood of success. Explore various strategies, continuously test and adapt, and select a reputable forex broker to support your trading endeavors.