Ideas on how to Be eligible for A florida Cellular Home loan?

The newest FHA even offers repaired-rates mortgages having all the way down loans-to-earnings ratios, borrowing and you may advance payment requirements, so it is common certainly first-date homeowners. Nevertheless they provide Identity I and Identity II money having were created land.

Name I financing try getting capital are manufactured properties, but not the house it lay on. There are some limitations, for instance the family is always to act as the dominating residence, fulfill FHA requirements in advance of are indexed for rent, has resources, and so on. Such fund are typically quick-name, two decades max, in accordance with lowest financing limits.

On the other hand, Name II financing can be used to together get an excellent prefabricated family and home about what it schedules. Mobile home parks and you may hired home commonly entitled to these types of money. Cellular property mainly based just before 1976 aren’t eligible too. These firms in addition to request the are available home feel classified because the real estate.

FHA interest levels are glamorous and frequently some of the most affordable offered. While doing so, closing expenses is greater than with other kinds of mortgage loans, in addition they apparently incorporate meantime build loan charge. The length of a loan might consist of 15 and you can 30 years. The new expected advance payment will be as low as step three.5 percent, since LTV is as high because the 96.5 per cent.

Va Financing

Should you want to to get a manufactured home in addition to parcel they stands into, you can seek an effective Va financing, which works much like an enthusiastic FHA Name II mortgage. Experts and you can effective-responsibility provider users qualify to have Va financing only given due to the fresh new Experts Products Company.

A Virtual assistant loan provides a great amount of experts, and no limitations towards the financing as well as the option to buy a property without deposit and you will home loan insurance coverage. But the manufactured domestic need lay on a fixed foundation, complete HUD conditions, and get gotten on the surface they consist onto be considered for it mortgage.

USDA Mortgage

To own outlying homebuyers, you could choose new USDA money. Speaking of backed by the newest department from farming and generally want zero deposit, meaning you will get a loan to invest in 100 % of your house’s well worth. Nonetheless they have additional charge, such a two % ensure percentage and you can an effective 5 % annual fee in addition monthly fees.

The additional charge are accustomed to counterbalance the enhanced risk owed towards large LTV. They likewise have a high minimal credit score than other mortgage loans, and you can feel turned-down if you make excess income. The maximum amount you can obtain try 115 percent of brand new county’s median income.

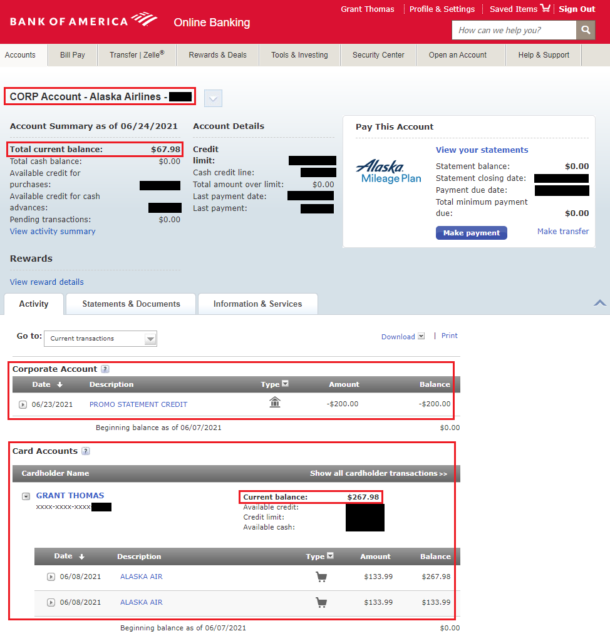

The entire process of being qualified to have a manufactured mortgage is fairly effortless. To start, consult with a houses consultant to establish your financial budget based on the kind of family you want to purchase savings account payday loans direct lenders and you can if or perhaps not you might be putting it on your land, leased homes, because of the coastline etcetera.

The debt-to-income ratio might possibly be determined making use of your gross monthly income and you will present debt obligations. From that point, your own housing adviser will highlight domiciles within your budget; that it more advances your odds of bringing that loan once you have chosen a home. Your own property professional tend to second assist you with the borrowed funds app procedure. They may be able help you in selecting the right real estate loan for your position.

What Credit score is necessary to own a mobile Financial inside Florida?

Extremely loan providers want the absolute minimum credit history away from 680 to finance a mobile home. However, even though your credit rating is nowhere close does not mean your can not score that loan. Of numerous financial institutions have been in the firm out-of credit currency therefore which they would not reject you a loan founded only on the credit rating. They are going to look at additional information and build financing for your requirements.